Machine learning and artificial intelligence are revolutionizing modern forex trading, with next-gen AI bots now leading the charge in strategy optimization, predictive analytics, and risk management. Advanced ML algorithms are designed to process vast historical and real-time market data—far beyond human capacity—extracting actionable patterns and rapidly adapting to evolving market conditions.

How Machine Learning Powers Forex Bots

AI trading bots leverage supervised learning, deep learning, and reinforcement learning techniques to deliver more accurate price predictions and faster, emotion-free trading decisions. These bots can spot non-linear relationships in forex price data, optimize order execution, and minimize slippage by constantly learning from both historical trends and live market signals. In milliseconds, bots analyze hundreds of currency pairs using technical and sentiment-based indicators—giving traders a decisive edge.

Predictive Analytics and Real-Time Adaptability

The backbone of next-gen forex bots is their use of predictive analytics. By dynamically mining market data with ML models, bots anticipate price moves and react instantly. As new data flows in, machine learning models automatically adjust strategies, ensuring ongoing adaptability to new market realities and volatility. Sentiment analysis with NLP further refines predictions by scanning news articles, social media, and financial reports—making bot strategies smarter and more context-aware.

Benefits for Traders in 2025

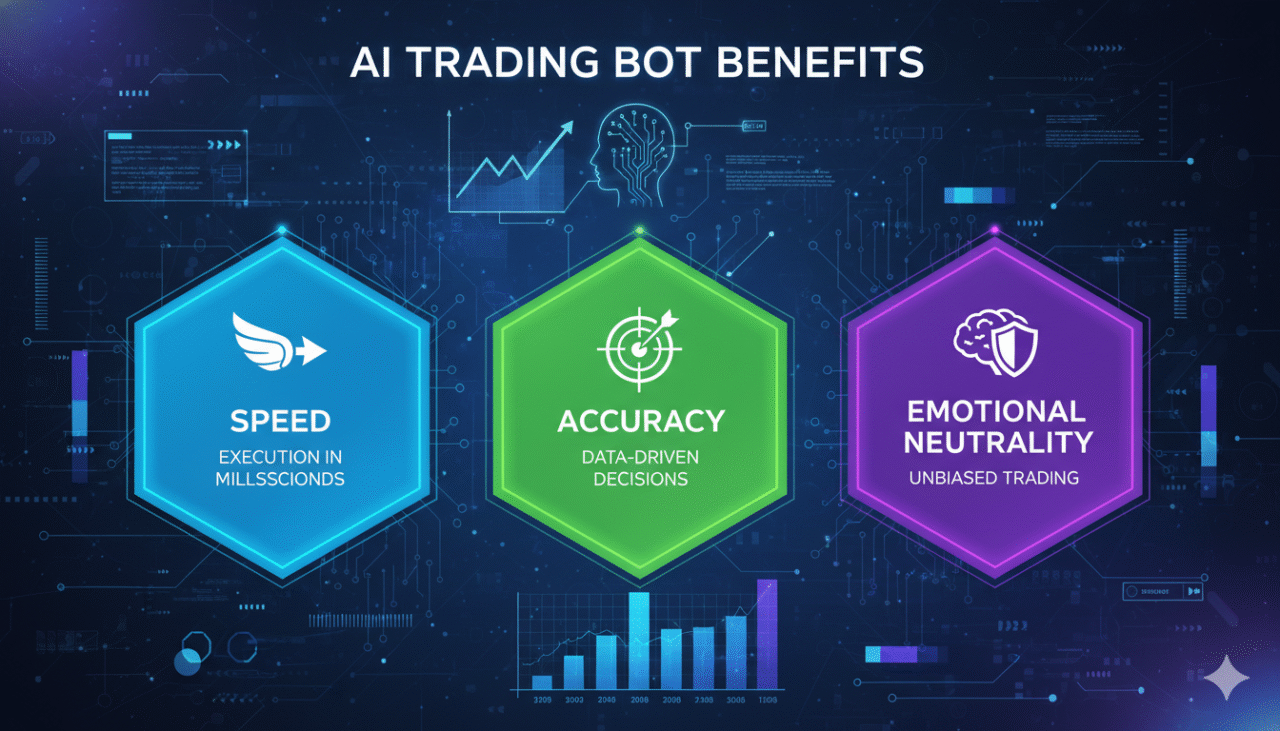

The incorporation of AI bots brings several game-changing advantages for forex traders:

• Real-time analysis and execution for optimal pricing.

• Greater forecasting accuracy thanks to deep learning models.

• Reduced emotional influence, enhancing discipline and consistency.

• Adaptive strategies that instantly respond to market changes.

These benefits help traders capitalize on fleeting opportunities, manage risk, and maintain profitability even in volatile environments.

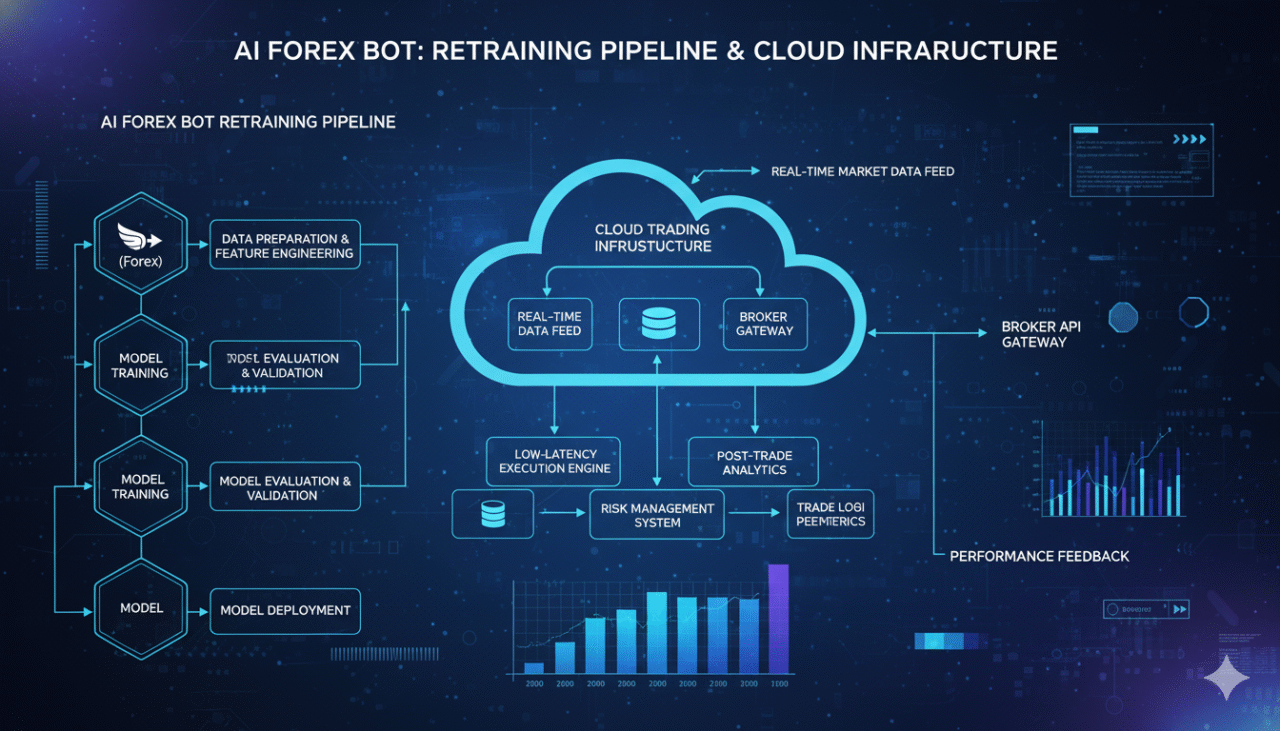

Overcoming Challenges

Despite their strengths, next-gen forex bots face challenges like model overfitting, latency, and computational requirements. Successful AI integration means retraining models with the latest data, combining rule-based and AI strategies, and using low-latency cloud infrastructure for rapid order execution. Traders and developers must balance automation power with robust oversight to ensure bots act reliably even in unexpected market scenarios.

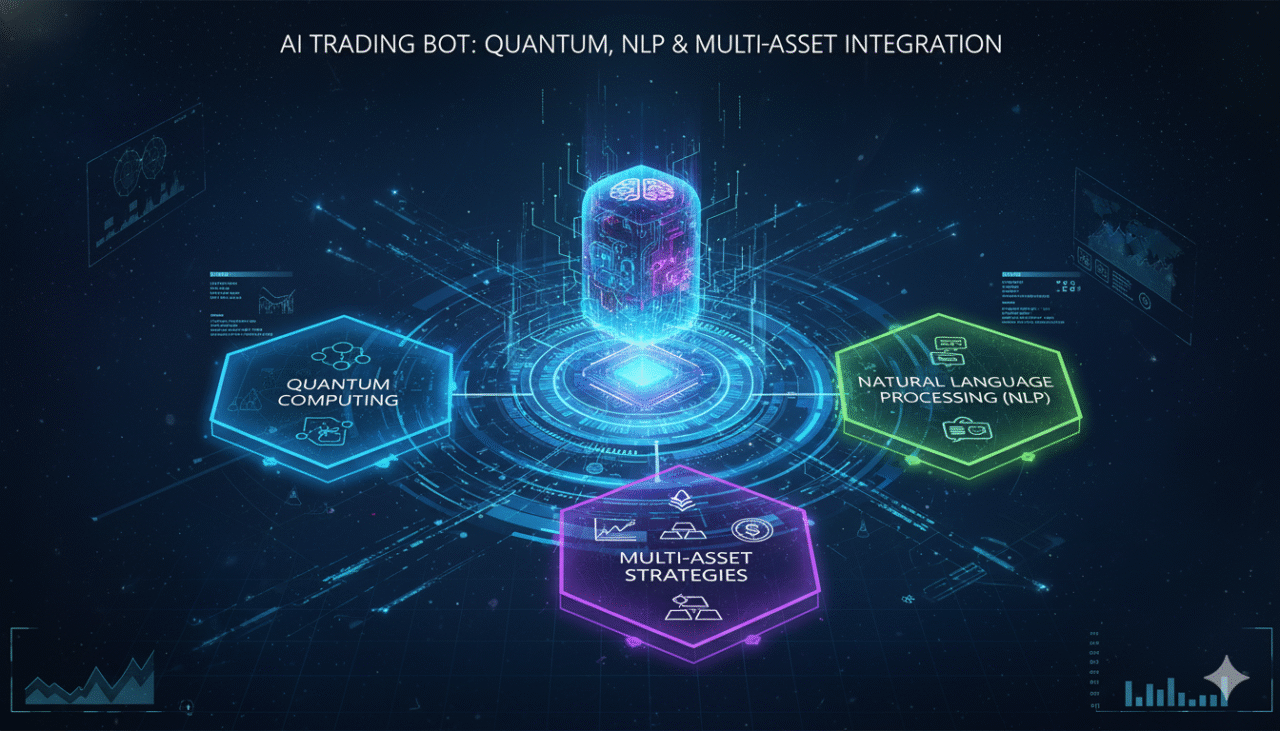

Future Outlook — The Evolution Continues

Looking ahead, the next wave of forex bots will further embrace advanced NLP, decentralized AI, and quantum computing for even sharper decision-making and market analysis. As AI dominates both institutional and retail trading platforms, bots will increasingly personalize strategies to individual trader profiles, maximizing ROI and building trader trust in continuously evolving forex markets.