AI at the Helm: Harnessing the Power of Neural Networks for Algorithmic Trading

Introduction:

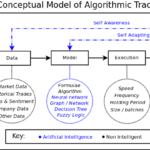

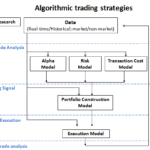

In recent years, technological advancements have revolutionized the financial industry, leading to the emergence of algorithmic trading as a dominant force in financial markets. Among the various tools and techniques employed in algorithmic trading, neural networks have gained significant attention for their ability to analyze complex data sets and make informed predictions. In this article, we will explore the role of neural networks in algorithmic trading, their advantages, challenges, and the impact they have on shaping the future of financial markets.

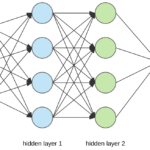

Understanding Neural Networks:

Neural networks are a subset of machine learning that draws inspiration from the human brain’s structure and functioning. These artificial neural networks consist of interconnected nodes, or neurons, organized into layers. The input layer receives data, which is then processed through hidden layers using weights and biases. The output layer produces the final prediction or decision. This architecture allows neural networks to learn patterns, relationships, and trends within data, making them powerful tools for predictive modeling.

Advantages of Neural Networks in Algorithmic Trading:

Pattern Recognition: Neural networks excel at recognizing intricate patterns within vast datasets, enabling them to identify potential trading opportunities that might be challenging for traditional algorithms.

Adaptability: Neural networks can adapt to changing market conditions by continuously learning from new data. This adaptability is crucial in dynamic financial markets where trends and patterns evolve over time.

Non-linearity: Financial markets often exhibit non-linear relationships, and neural networks are well-suited to model and capture these complex dynamics. This enables more accurate predictions of market movements.

Feature Extraction: Neural networks can automatically extract relevant features from raw data, reducing the need for manual feature engineering. This capability is particularly beneficial in financial markets, where identifying relevant features is often a complex task.

Challenges and Considerations:

While neural networks offer significant advantages, they also pose challenges in the context of algorithmic trading:

Overfitting: Neural networks can be prone to overfitting, where the model performs well on training data but fails to generalize to new, unseen data. Implementing techniques such as dropout and regularization can mitigate this risk.

Computational Resources: Training complex neural networks can be computationally intensive, requiring substantial resources. Traders must balance the benefits of a sophisticated model with the practical constraints of real-time trading.

Interpretability: Neural networks are often referred to as “black-box” models because understanding the decision-making process can be challenging. Interpretable models are crucial in financial markets where transparency is valued.

Data Quality: The performance of neural networks heavily depends on the quality of input data. Noisy or biased data can lead to inaccurate predictions and financial losses. Thorough data preprocessing and validation are essential.

The Future of Algorithmic Trading with Neural Networks:

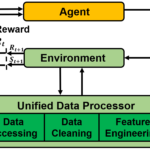

As technology continues to evolve, neural networks are expected to play an increasingly prominent role in algorithmic trading. Researchers are exploring advanced architectures, such as recurrent and attention-based networks, to enhance model performance. Additionally, the integration of reinforcement learning techniques allows neural networks to make adaptive decisions based on feedback from the trading environment.

Regulatory bodies are also closely monitoring the use of artificial intelligence in financial markets to ensure fair and transparent trading practices. As the industry continues to adopt neural networks, it is essential to strike a balance between innovation and regulatory compliance.

Conclusion:

Neural networks have emerged as powerful tools for algorithmic trading, providing traders with the capability to analyze vast amounts of data and make informed decisions in dynamic financial markets. While challenges such as overfitting and interpretability persist, ongoing research and technological advancements are addressing these concerns. As the financial industry continues to embrace artificial intelligence, the synergy between neural networks and algorithmic trading is poised to shape the future of financial markets, ushering in an era of efficiency, adaptability, and data-driven decision-making.