Trading Mistakes Beginners Make

If you’ve ever wondered why most beginner traders lose money — you’re not alone.

The truth is, it’s not the market that beats them… it’s their mindset and mistakes.

But here’s the good news: with the rise of AI-powered trading software, these mistakes are no longer permanent — they’re fixable.

Let’s break down the three biggest trading mistakes beginners make, and how AI changes the game forever.

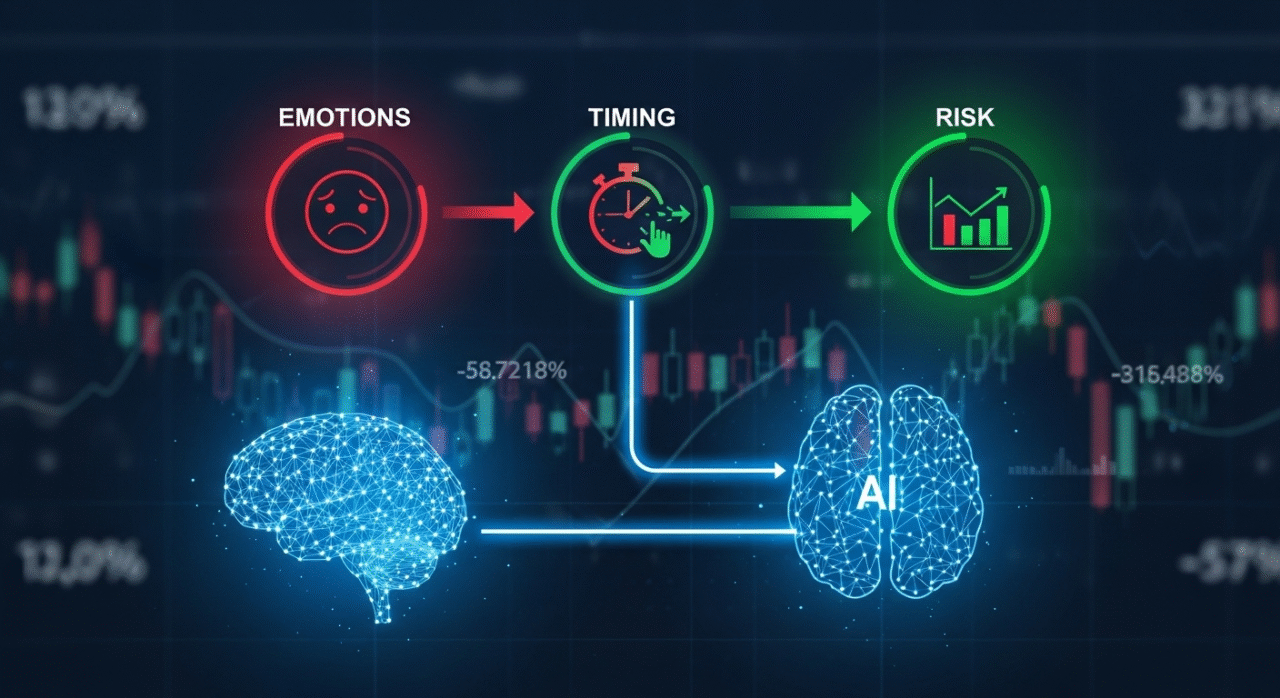

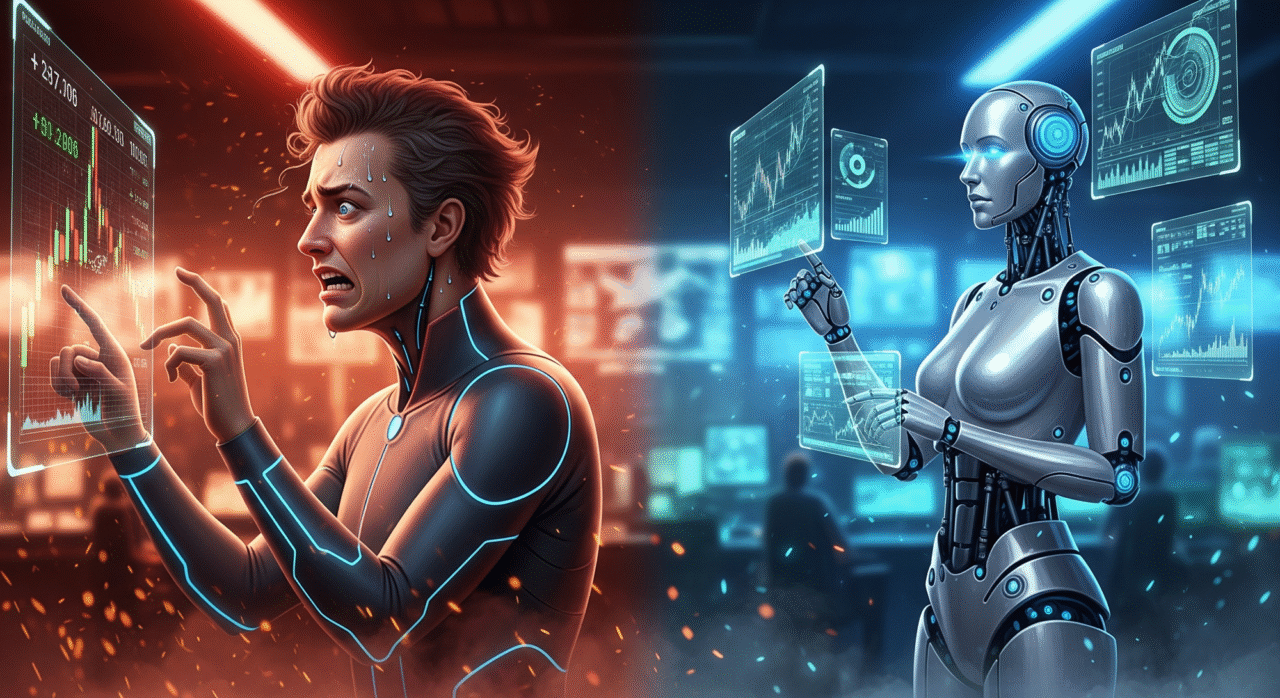

1️⃣ Emotional Trades – Letting Feelings Control Decisions

One minute you’re confident, the next you’re panicking.

Fear and greed are a trader’s biggest enemies. Beginners often buy too high (FOMO) or sell too early (fear of loss).

AI-based systems, like X-STOX META 2.0, eliminate emotions completely.

They analyze thousands of data points objectively and give Buy/Sell signals based purely on logic — not feelings.

👉 AI doesn’t panic. It just calculates.

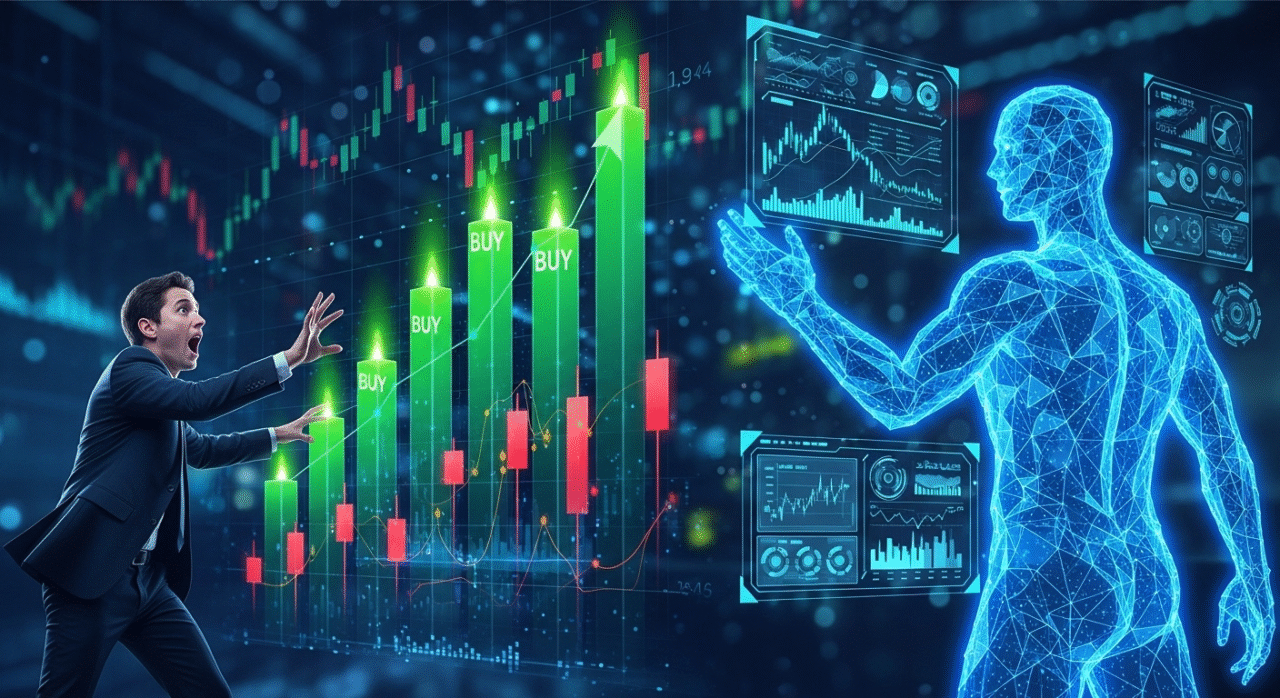

2️⃣ Late Entries – Missing the Right Moment

Timing is everything in trading.

Beginners usually react after a move happens — they chase green candles and enter late.

By then, smart traders (and algorithms) have already taken profits.

AI changes that.

With real-time analysis and predictive indicators, AI trading tools identify patterns before they become obvious — helping you enter early and exit wisely.

👉 AI doesn’t wait. It anticipates.

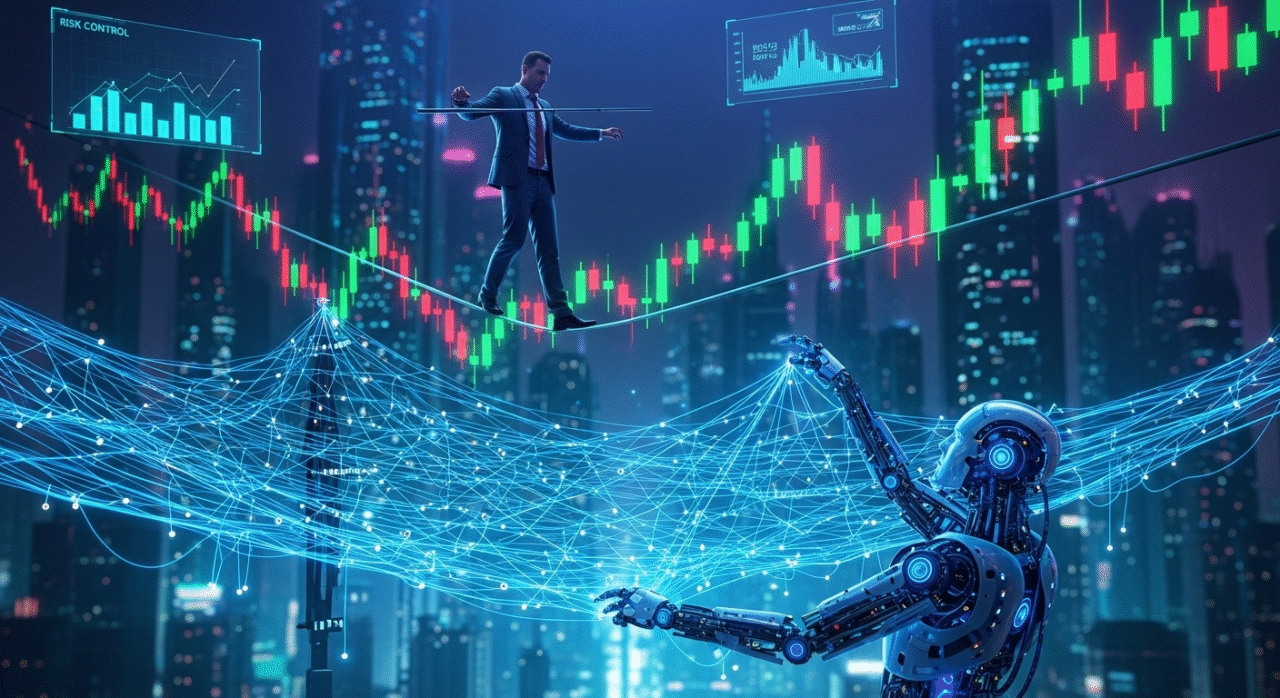

3️⃣ No Risk Management – Trading Without a Safety Net

Beginners often focus on profits, not protection.

They risk too much on one trade or don’t set stop-loss levels at all.

The result? One bad move wipes out all gains.

AI systems use automated risk management and smart position sizing to ensure that every trade fits within safe limits.

Your capital stays protected while your strategy scales with discipline.

👉 AI doesn’t gamble. It manages risk.

✅ So How Does AI Fix All Three?

AI trading tools like X-STOX META 2.0 combine advanced algorithms, machine learning, and technical analysis to simplify trading for everyone — from beginners to pros.

“Trade smarter, not harder. Let AI handle the chaos.”

🚀 Final Thoughts – The Future Belongs to Smart Traders

If you’re just starting out, remember this:

Success in trading isn’t about luck — it’s about logic.

AI tools are giving retail traders the same power once reserved for big institutions.

The sooner you adapt, the sooner you win.

So, stop guessing. Start evolving.

Let X-STOX META 2.0 guide your next trade — with precision, confidence, and zero emotion.